SMART CREDIT INFRASTRUCTURE FOR BUSINESS GROWTH

Transform Your Business with Expert Credit & Funding Solutions

You built the vision. We bring the capital.

Fast approvals. Strategic stacking. Credit-based + Revenue Funding Programs built for entrepreneurs ready to scale.

PROBLEM

Struggling to Get the Funding You Deserve?

You’re not alone — most entrepreneurs hit roadblocks when chasing capital.

At Money Mela Funding, we cut through the red tape, fix what’s holding you back, and connect you to real lenders who understand small business growth.

Banks Move Slow:

Traditional lenders stall your momentum with red tape and long waits. How I help: I connect you with lenders who fund fast — no wasted time.

Lenders Don’t Get Entrepreneurs:

They judge your score, not your hustle. How I help: I match you with programs built for self-made business owners.

Using Personal Credit for Business:

Every swipe and loan hurts your personal score.

How I help: I structure funding that separates business from personal credit.

Waiting for “Perfect”:

Perfection delays progress — and profits. How I help: I help you build, fix, and fund simultaneously to keep momentum high.

THE SOLUTION

Ready to Turn Setbacks Into Funding Power Moves?

Here’s how we help entrepreneurs build, fund, and grow — without the confusion or long waits.

💼 Fast Funding Approvals

Get pre-approved in 24–72 hours with our network of lenders who actually understand small business owners.

💳 Credit Rebuild & Readiness Program

We help enhance and rebuild your credit using proven consumer laws — setting you up to qualify for high-limit funding fast.

📈 Funding Stack Game Plan

We build a personalized roadmap showing how to access $50K–$250K using a mix of credit and business capital.

🧠 Expert Guidance & Support

You’ll never feel lost — we walk with you from application to approval, and show you how to multiply your results.

Your vision’s ready. The funding’s waiting. Let’s make your next move your best move.

OUR SERVICES

Funding power. Credit mastery. Business elevation.

Everything you need to build, grow, and get capital ready.

Credit Rebuild & Readiness

We enhance and rebuild your credit using proven consumer laws — preparing you for high-limit personal and business funding.

Personalized credit audit & dispute plan.

Custom Metro 2 compliance letters.

Credit rebuilding roadmap.

FREE Credit Audit

Ongoing score tracking & support

Business Formation & Structure

Set up your business the right way — from LLC to EIN — and position it to qualify for maximum funding.

Business entity setup (LLC, EIN, DUNS)

Tier-1,2 & 3 vendor account recommendations

Business credibility checklist

FREE Business Audit

Funding-ready compliance guide

Funding Strategy & Stacking

Access $50K–$250K in capital through strategic credit stacking, revenue-based loans, and lines of credit.

Funding pre-qualification & analysis

Lender & card stack strategy

0% interest funding options

FREE Business Scan

Application support & approval tracking

Automation & Growth Systems

Automate your business operations, leads, and client funding process so you can scale with freedom and precision.

CRM setup (Go High Level or Monday)

Funnel & email automation templates

Client intake & funding workflow

FREE Funding Funnel Blueprint

Ongoing tech support & optimization

TESTIMONIAL

What our customers are saying...

See how our services are making a difference for businesses like yours.

The logo and branding designs we received are beyond our expectations. Our new visual identity has helped us stand out and connect with our customers more effectively.

Mandy Wu

Product Manager

The team delivered exactly what we wanted, and our social media engagement has increased significantly since using their designs. Highly recommend!

James L.

Marketing Director

I loved how they brought our vision to life. Their designs are creative, professional, and aligned perfectly with our brand values. The entire process was seamless.

Claire D.

Small Business Owner

Our website design is sleek and user-friendly. We’ve seen a noticeable increase in website traffic and sales. Couldn’t be happier with the outcome.

Lisa S.

eCommerce Business Owner

LIMITED TIME OFFER

Here’s what you’ll get...

Build your foundation for success — clean credit, structured business, funding strategy, and automation tools — everything you need to get capital-ready and scale with confidence.

OFFER 1

Credit Audit & Dispute Launch

We start by breaking down your credit reports line by line, identifying inaccurate and unverifiable accounts using consumer laws. You’ll get personalized Metro 2 dispute letters crafted to delete negative items and boost your score quickly.

OFFER 2

Business Formation & Compliance Setup

Whether you’re starting fresh or restructuring, we’ll help you set up your business correctly — from forming your LLC to building the compliance that lenders look for. You’ll walk away funding-ready with the structure, paperwork, and vendor accounts in place.

OFFER 3

Funding Pre-Approval Strategy Call

You’ll sit down for a private 30-minute strategy session to map out your personalized credit and business funding plan. We’ll identify your funding tiers, best lender matches, and how to stack your approvals for maximum leverage — without damaging your credit.

OFFER 4

Automation Jumpstart Kit

Save hours every week by automating your client process. We’ll plug you into proven CRM templates and messaging workflows that capture leads, follow up automatically, and keep your clients engaged while you focus on growth.

OFFER 2

Business Formation & Compliance Setup

Whether you’re starting fresh or restructuring, we’ll help you set up your business correctly — from forming your LLC to building the compliance that lenders look for. You’ll walk away funding-ready with the structure, paperwork, and vendor accounts in place.

OFFER 3

Funding Pre-Approval Strategy Call

You’ll sit down for a private 30-minute strategy session to map out your personalized credit and business funding plan. We’ll identify your funding tiers, best lender matches, and how to stack your approvals for maximum leverage — without damaging your credit.

OFFER 4

Automation Jumpstart Kit

Save hours every week by automating your client process. We’ll plug you into proven CRM templates and messaging workflows that capture leads, follow up automatically, and keep your clients engaged while you focus on growth.

Special Offer

limited-time promotion

ONLY $499

Original Price: $1,497

HOW IT WORKS

Get Funded Faster with Effortless Automation

We’ve simplified the path to capital — from credit repair to full business funding

— so you can move from setup to success without the stress.

Step 1: Clean & Prepare Your Credit

We audit, dispute, and rebuild your

credit using proven consumer-law strategies,

clearing the path for high-limit approvals.

✅ 3-bureau audit & Metro 2 letters

✅ Credit rebuild roadmap

✅ Score tracking setup

Step 2: Build a Funding-Ready Business

Your business structure matters. We help you form your LLC, build credibility, and position for lender trust.

✅ LLC, EIN & DUNS setup

✅ Business credit checklist

✅ Vendor & bank setup guide

Step 3: Get Matched With the Right Lenders

We analyze your credit and revenue to match you with lenders that fit your goals — fast approvals, zero guesswork.

✅ Credit & business review

✅ Pre-approval & stacking plan

✅ Access to $50K–$250K in funding

Step 4: Automate & Scale Your Systems

Turn your funding flow into a seamless machine — automate onboarding, communication, and follow-ups so you grow on autopilot.

✅ CRM setup & funnel template

✅ Follow-up text & email sequences

✅ Client automation dashboard

💰 You focus on growth — we handle the funding flow.

SUCCESS STORIES

We love to see you grow

Join the countless businesses we've helped scale with ease and efficiency.

GraphicPro Studio struggled with inconsistent project delivery, low client retention, and inefficient workflow systems.

After using MelatheMLO:

40%

Faster project completion

50%

Increase in sales conversion

DigitalMark was facing difficulties in generating quality leads, inefficient marketing funnels, and low social media engagement.

After using MelatheMLO:

45%

Reduction in turnaround time

60%

Improvement in lead generation

FAST TRACK YOUR SUCCESS

Transform Your Credit & Funding Power — From Chaos to Capital

Watch what happens when strategy, structure, and automation take over.

BEFORE using Funding Systems:

Denied by Traditional Lenders

Personal Credit Stretched Thin

No Strategy or Structure

Manual Client Follow-Ups

Low Cash Flow = Missed Opportunities

Working Harder, Not Smarter

AFTER using Funding Systems:

Quick Pre-Approvals

Clean & Powerful Credit Profile

Structured for Success

Automated Client Flows

Consistent Cash Flow

Freedom to Grow

JOIN THE SUCCESS JOURNEY

If you know you’re ready for more…

We need to talk

For Hustlers

Ready to grow but stuck waiting on funding.

For Business Owners

You’re working hard, but nothing is automated or optimized.

For Visionaries

You know what you want — your credit just needs to catch up.

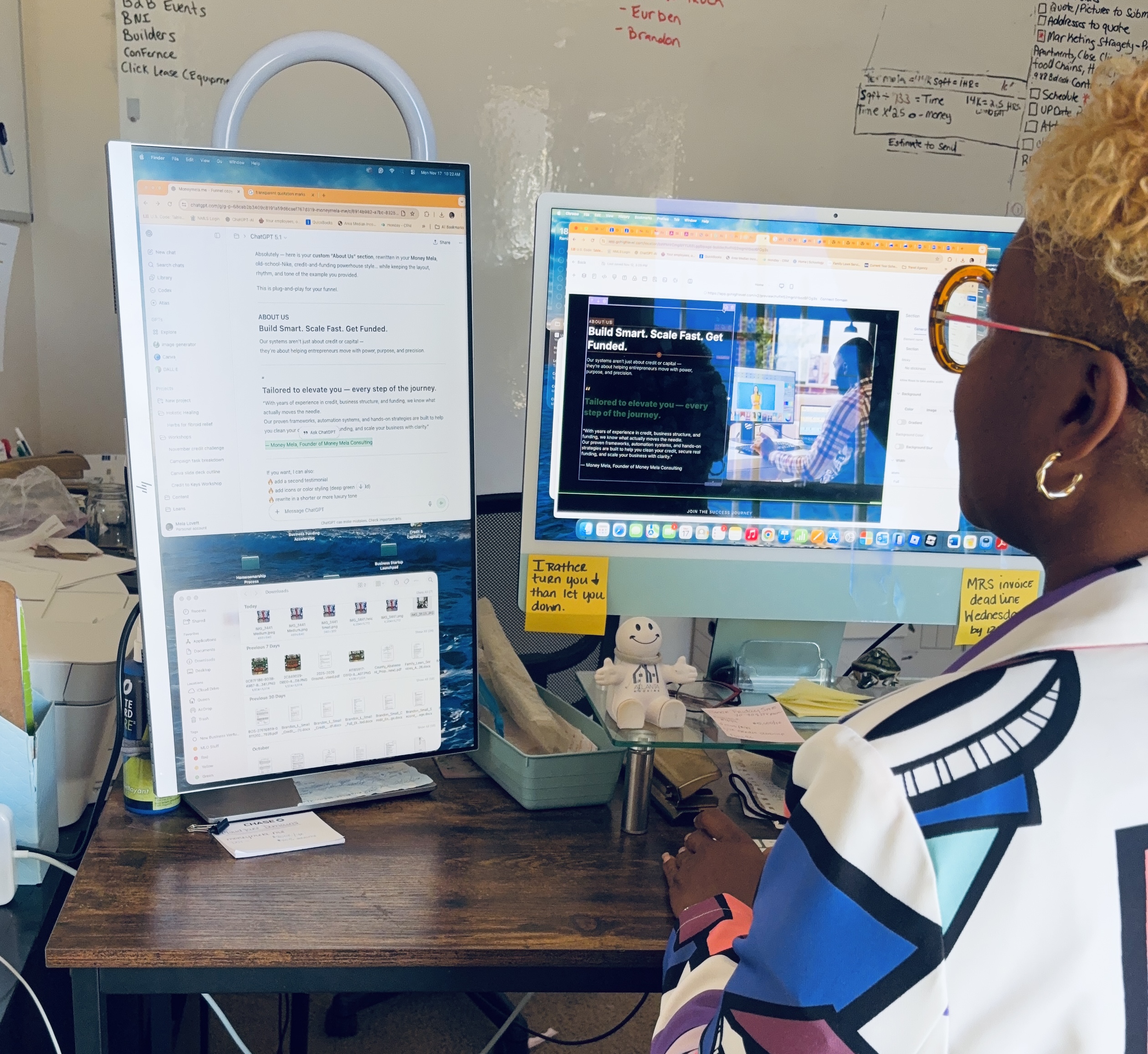

ABOUT US

Build Smart. Scale Fast. Get Funded.

Our systems aren’t just about credit or capital —

they’re about helping entrepreneurs move with power, purpose, and precision.

“

Tailored to elevate you — every step of the journey.

“With years of experience in credit, business structure, and funding, we know what actually moves the needle.

Our proven frameworks, automation systems, and hands-on strategies are built to help you clean your credit, secure real funding, and scale your business with clarity.”

— Money Mela, Founder of Money Mela Consulting

JOIN THE SUCCESS JOURNEY

Stay Connected, Stay Ahead.

Join our network for valuable insights, updates, and resources to fuel your growth.

Join Our Community

Connect with a network of growth-driven individuals and gain valuable insights.

Subscribe Our Newsletter

Receive the latest industry trends, expert advice, and exclusive offers directly to your inbox.

FAQ

Frequently Asked Questions

Everything you need to know before starting your funding journey.

Will applying hurt my credit?

No. Our pre-qualification process uses soft pulls only, so your credit score stays protected while we assess your funding options.

How fast can I get approved for funding?

Most clients receive pre-approvals within 24–72 hours after submitting the required information.

If you’re credit-ready, funding can move even faster.

What credit score do I need?

We work with a wide range of clients:

600+ → entry-level funding options

680+ → stronger approvals

700+ → premium limits & better rates

If you’re not ready, we help you get ready.

What makes your system different?

We combine credit repair + business setup + funding strategy + automation into one powerful ecosystem.

No guessing. No wasted time.

Just a proven path to capital.

Do you help set up my business correctly?

Absolutely.

We handle:

*LLC setup

*EIN & DUNS

*Business credibility

*Vendor accounts

*Compliance checklist

Everything lenders need to trust your business.

What if I need help rebuilding my credit first?

No problem — that’s our specialty.

We use consumer law, Metro 2 compliance, and strategic rebuilding to clean, enhance, and strengthen your credit profile so you can qualify for higher limits.

Do you offer support after funding?

Yes — you get access to ongoing strategy, automation tools, and growth guidance so you can use your funding wisely and scale without burnout.

What if I don’t know where to start?

Easy.

Start with our Funding Strategy Assessment — we’ll tell you exactly where you stand and what you qualify for.

Ready to Elevate to the Next Level?

Your credit, your business, and your future deserve a strategic upgrade — let’s build it together.